Worldwide Insurance Brokers and Advisors Limited

Unit 20 Sandyford Office Park

Sandyford

Dublin 18

tel: +353 (1) 2948669

fax: +353 (1) 6968966

e: info@worldwide.ie

Registered in the Company’s registration under company no. 499836

Worldwide Insurance Brokers and Advisors Limited is regulated by the Central Bank of Ireland

These terms of business set out the basis on which Worldwide Insurance Brokers and Advisors Limited will provide business services to you as a client of Worldwide Insurance Brokers and Advisors Limited. They also contain details of our regulatory and statutory obligations and the respective duties of both Worldwide Insurance Brokers and Advisors Limited and you in relation to such services.

Authorised Status

Worldwide Insurance Brokers and Advisors Limited is regulated by Central Bank of Ireland under the European Union (Insurance Distribution) Regulations 2018, (‘the IDR’), Registration No: 90992. Copies of our various authorisations are available on request. Our authorisations can be verified by contacting the Financial regulator on 1890 77 77 77.

Codes of Conduct

Worldwide Insurance Brokers and Advisors Limited is subject to and complies with the following Central Bank of Ireland Codes of Conduct: Consumer Protection Code, Minimum Competency Code and the Fitness & Probity Standards. These codes offer protection to consumers and can be found on www.centralbank.ie

Services Provided

We will offer broad based advice on a fair analysis basis in relation to general insurance policies. We will identify and select a suitable product producer and on receipt of your instructions we will transmit orders on your behalf to one or more product producers (a list of which is available on request).

This firm does not have ‘tied’ relationship with any institution that would compromise our ability to offer you independent advice and choice.

Conflict of Interests

It is the policy of Worldwide Insurance Brokers and Advisors Limited to avoid any conflict of interest when providing business services to its clients. However, where an unavoidable conflict arises we will advise you of this before proceeding to provide any business service. If you have not been advised of any such conflict you are entitled to assume that none arises.

Premium Handling

Worldwide Insurance Brokers and Advisors Limited will accept payments in cash, by cheque and by credit/debit card or lodgements (including electronic transfer lodgements) to our bank account in respect of general insurance in the circumstances permitted under Section 25G of the Investment Intermediaries Act, 1995. Worldwide Insurance Brokers and Advisors Limited is not authorised to accept cash or negotiable instruments in any other circumstances.

Premiums are due on / or before renewal / inception date. Under Central Bank regulations very strict rules apply in the payment of premiums to Insurance companies. We can-not pay premiums to insurers which have not been received from clients. Therefore, to avoid policy cancellation, premiums must be paid strictly within the credit terms if agreed, otherwise immediately prior to cover incepting.

Cooling Off Period

A consumer (as defined by SI No. 853 of 2004) has the right to withdraw from an insurance policy (as defined under SI No. 853 of 2004) within 14 working days of the start date of the policy without penalty and without giving any reason – this is known as the Cooling Off period. The right of withdrawal may be exercised by notice in writing to Worldwide Insurance Brokers and Advisors Limited, quoting your policy number.

If the cover is motor insurance the premium cannot be refunded until the Certificate of Insurance and Windscreen Disc have been received by Worldwide Insurance Brokers and Advisors Limited.

Cancellation

You, the customer can cancel your policy by notice in writing at any time. Provided that all reasonable charges pertaining to costs incurred by Worldwide Insurance Brokers and Advisors Limited have been paid and provided that no incident giving rise to a claim has occurred in the current period of insurance, you will be entitled to a proportionate return of the premium for the un-expired period of insurance unless the policy is on a minimum and deposit basis, and if this is the case, no return will be allowed on the policy and this will be noted on your policy schedule.

If you cancel during the first year (outside of the Cooling Off period) short term rates will apply, please see policy terms and conditions. In the case of cancellation of motor insurance you must return the Certificate of Insurance and Windscreen Disc to Worldwide Insurance Brokers and Advisors Limited. Insurance companies normally reserve the right to cancel policies at any time by giving appropriate notice to your last known address. Please refer to your policy terms and conditions.

Failure to pay or default

We reserve the right to instigate cancellation proceeding in the event of the following:

- your non-payment of the premium due at inception, renewal or following a mid-term adjustment

- your bank returns your cheque due to insufficient funds or any other reason

- non-disclosure of relevant information

- failure to supply all required documents

- Insurer imposed cancellation

- Your insurer may cancel your policy in certain circumstances. These conditions are clearly outlined on all policy documents.

When your policy ends or is cancelled, we will send you any documentation and information that you are entitled to on request.

Complaints Procedure

The company has a written procedure in place for the effective consideration and handling of complaints. Any complaints should be addressed in writing to the Compliance Officer, Worldwide Insurance Brokers and Advisors Limited. Each complaint will be acknowledged by us within 5 working days of receipt, updates will be advised in intervals of not more than 20 working days, we will endeavour to resolve the complaint within 40 business days and findings will be furnished to you within 5 working days of completion of the investigation. In the event that you are not entirely satisfied with Worldwide Insurance Brokers and Advisors Limited’s handling of and response to your complaint, you have the right to complain to the Financial Services Ombudsman, 3rd Floor, Lincoln House, Lincoln Place, Dublin 2.

Remuneration and Fees

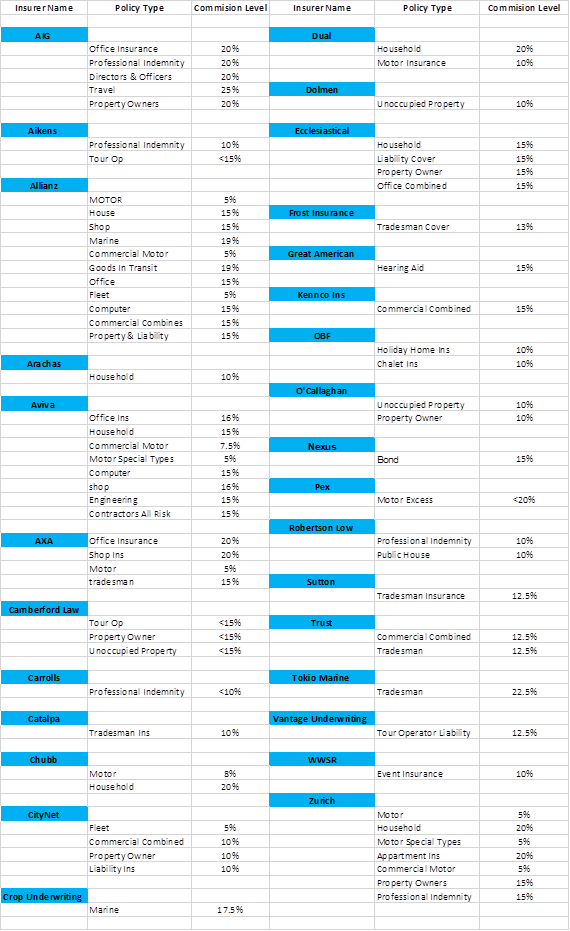

Worldwide Insurance Brokers and Advisors Limited is remunerated by a professional fee for the initial work activity and time spent in seeking the best terms, advice, product and product producer for your specific needs. An administration fee is also charged for the activity involved in the renewal of the policy and also any alterations that take place during and at termination of a policy. A scale of our fees is under noted. We are usually remunerated by commission received from the product producers for the work involved in placing an order and finalising the product with them on your behalf. The range of commission can vary, depending on the product, between 0% and 25% Some product producers do not pay a commission. Click here for list of suppliers and their commission levels

Scale of Fees

The following is the scale of fees that are applied to the various types of business we transact and can be charged as a combination of Commissions and Fees but all as described herein:

- Motor (both private & commercial): up to €75 or up to 30% or the premium, whichever is the higher,

- Motor mid-term adjustments/cancellation: up to €50, or up to 30% whichever is the higher.

- Household: up to €30, or up to 20% whichever is the higher,

- Household midterm adjustments/cancellation: up to €20, or up to 30% whichever is the higher.

- Commercial (all other classes of business): up to 30% of the premium, midterm adjustments/cancellation up to 15% of the premium.

- Scheme /Affinity /Website or Association Business: This type of Business transaction is different to our usual Personal and Commercial Business and remuneration is by a combination of commission and fees. Commission if any, is received from Product Producers to whom orders are transmitted. Some Product Producers pay NO commission. The Premium charged for this specific class of Business includes all administration charges and reflects the costs of website trading/marketing and time involved in producing the eventual product delivery (e.g. The cost of cover, sourcing of product/scheme, administration costs, website creation and maintenance, risk management, claims handling assistance, renewal negotiation, compliance costs and advice. We may on occasion source product through a Wholesale Broker. The Wholesale Broker may charge a fee for this service which will be reflected in the price of the product. There is no VAT charge on any insurance transaction however stamp duty and/or government levies may apply.

A full Breakdown of these charges will be provided on application.

We reserve the right to amend these fees should the complexity of the product require a higher fee. We will confirm and agree this fee with you prior to any increased charge being applied.

- A fee of €25 will be charged for all duplicate documentation. A fee of €25 will be charged for driving experience letters.

- Policies paid by Direct Debit are subject to a minimum fee of €40

- If a finance agreement goes into default we will charge a €5 late payment fee for each instalment

- Our Brokerage Fee is payable within the Cooling Off Period.

Investor Compensation

Worldwide Insurance Brokers and Advisors Limited is a member of the Investor Compensation Company Ltd (ICCL) Scheme established under the Investor Compensation Act, 1998. The legislation provided for the establishment of a compensation scheme and to the payment in certain circumstances, of compensation to certain clients of firms (known as eligible investors) covered by the Act. However, you should be aware that a right to compensation would only arise where client money held by this company on your behalf cannot be returned, either for the time being or for the foreseeable future, and where the client falls within the definition of eligible investor as contained in the Act. In the event that a right to compensation is established, the amount payable is the lesser of 90% of the client’s loss, which is recognised as being eligible for compensation, or €20,000.

Data Protection

Worldwide Insurance Brokers and Advisors Limited is a Data Controller as defined in the Data Protection Act 1988 and 2003. We collect your personal details in order to provide the highest standard of service to you. We take great care with the information provided; taking steps to keep it secure and to ensure it is only used for legitimate purposes. To fulfil these objectives we may share information with other affiliated professionals. The information and other data provided to our office may be used to advise you of products and services we may offer from time to time.

You have the right at any time to request a copy of any ‘personal data ’within the meaning of the Data Protection Act 1988 (as amended or re-enacted from time to time) that our office holds about you and to have any inaccuracies in that information corrected.

Solvency of Insurance Providers

In selecting an Insurer, a wide variety of factors are taken into account including the financial status of the Insurer in question. However, we cannot and do not guarantee the solvency of any Insurer with which we place business. We deny any liability in the event of an Insurer becoming insolvent.

Governing Law and Language

The laws of the Republic of Ireland form the basis for establishing relations between you and Worldwide Insurance Brokers and Advisors Limited. All contracts, terms, conditions and communications relating to any policies you may enter with this firm will be in English. The terms set out above apply to any service provided to you after 1st November 2011, and should Worldwide Insurance Brokers and Advisors Limited change its terms you will be notified in advance.

Material Facts / Duty of Disclosure / Misrepresentation of Risk

Every Proposer or Insured when seeking a new policy of insurance or cover for additional risks or renewal under an existing policy, must disclose any information that might influence the insurer in fixing the premium or determining whether to accept the risk. Every Proposer or Insured are required to answer questions honestly and with reasonable care; failure to do so may mean voidance, part payment or non-payment of a claim.

A “Material Change” will be interpreted as referring to changes that take the risk outside that which was reasonably envisaged by both consumer and Worldwide Insurance Brokers / the Insurer when the policy sale was concluded

If you are in any doubt as to whether information is material, you should disclose it.

Commissions Payable to Worldwide Insurance Brokers and Advisors Ltd.

Last Updated: February 2021